당신은 주제를 찾고 있습니까 “ares eif newark energy center – How to get from NYC airports to city center without getting ripped off“? 다음 카테고리의 웹사이트 https://ro.taphoamini.com 에서 귀하의 모든 질문에 답변해 드립니다: ro.taphoamini.com/wiki. 바로 아래에서 답을 찾을 수 있습니다. 작성자 Sarah Funk 이(가) 작성한 기사에는 조회수 605,525회 및 좋아요 15,406개 개의 좋아요가 있습니다.

Table of Contents

ares eif newark energy center 주제에 대한 동영상 보기

여기에서 이 주제에 대한 비디오를 시청하십시오. 주의 깊게 살펴보고 읽고 있는 내용에 대한 피드백을 제공하세요!

d여기에서 How to get from NYC airports to city center without getting ripped off – ares eif newark energy center 주제에 대한 세부정보를 참조하세요

Let me plan your NYC vacation: https://sarahfunky.com/nyc-concierge/

Get the FREE 3-day NYC itinerary: http://bit.ly/NYCitinerary2021

Join my NYC tours! https://funkyexperiences.com/

How to see the best of New York for under $100: https://bit.ly/NYCunder100

Sharing my insider tips with you on how to get from the NYC airports to the city center without getting ripped off. In this video, I will cover the cheapest and best ways to get from JFK, LaGuardia, and Newark Airport to Manhattan.

LINKS MENTIONED IN VIDEO:

Written directions here: http://bit.ly/NYCairportTips

Weekend city ticket purchase instructions: http://web.mta.info/mta/cityticket.htm

Buy Newark Airport Express tickets here: https://newarkairportexpress.com/

FASHION WORN IN THIS VIDEO:

Ana Luisa Olivia Pink Tassel Earrings: Use code FUNKY15 for $15 off. https://www.analuisa.com/products/olivia-pink-earrings

Gingham dress: Use code FUNKY20 for 20% off. https://saratogasundress.com/

Kattee leather tote bag: https://amzn.to/2KwGIOb

WATCH MY NYC VIDEOS:

NYC Local Guides: https://bit.ly/NYCGuidePlaylist

NYC neighborhood Guides: https://bit.ly/NYCneighborhoods

NYC Scams \u0026 tourist traps: https://bit.ly/NYCscamsPlaylist

NYC Budget Guide: https://bit.ly/NYCbudgetguide

WATCH MY TRAVEL VIDEOS:

World travel guides: https://bit.ly/WorldTravelPlaylist

US travel guides: https://bit.ly/USTravelPlaylist

JOIN MY NYC TOURS! http://bit.ly/BookMyTourNow

GET MY NYC E-BOOKS: https://www.sarahfunky.com/nyc-shop

RESOURCES:

Join my NYC All-Access Insiders Only Community: http://bit.ly/Patreon18

Equipment used to shoot this video: https://bit.ly/SFequiptment

My travel essentials: https://bit.ly/TravelSF20

NYC packing lists: https://www.amazon.com/shop/sarahfunky

Support my work: https://www.sarahfunky.com/support-my-work

Save $40 on Airbnb: https://www.airbnb.com/c/luisy13

Save $5 on your first Lyft – https://lyft.com/ida/FUNK66734

SOCIAL:

Instagram: https://www.instagram.com/sarahfunky/

Twitter: @SFunkyTravel

Facebook: https://www.facebook.com/SarahFunkyExperience/

My filming equipment list: https://bit.ly/BestVideoEquipment21

ares eif newark energy center 주제에 대한 자세한 내용은 여기를 참조하세요.

Newark Energy Center, US – Power Technology

Newark Energy Center is a 655MW gas fired power project. It is located in New Jersey, the US. The project is currently active.

Source: www.power-technology.com

Date Published: 10/17/2022

View: 2784

Ares-EIF Puts PJM CCGT on Block – Power Finance & Risk

Citi is advising the private equity firm on the sale of the 705 MW Newark Energy Center project, according to a teaser seen by PFR.

Source: www.powerfinancerisk.com

Date Published: 9/9/2022

View: 5144

Ares Management’s Energy Infrastructure Funds Divest …

Ares Management L.P. (NYSE: ARES) announced today that funds managed by its … Oregon Clean Energy and Newark Energy Center as well as its …

Source: www.businesswire.com

Date Published: 9/30/2021

View: 1632

Ares Management to acquire power generator EIF Management

“During the course of negotiations, Ares and EIF always contemplated a … power plant in California, the Newark Energy Center under construction in New …

Source: www.transmissionhub.com

Date Published: 11/30/2022

View: 233

Newark Energy Center – Wikipedia

The Newark Energy Center is a 655-megawatt gas fired power plant in Newark, New Jersey. Approved in 2011, with construction beginning in 2012 it began …

Source: en.wikipedia.org

Date Published: 3/8/2021

View: 793

Newark energy center – GEM.wiki

Newark energy center is a 735-megawatt (MW) natural gas power station in … Owner: Energy Investors Funds [100%]; Parent: Ares Management …

Source: www.gem.wiki

Date Published: 5/26/2022

View: 110

Ares to acquire Energy Investors Funds

Recent investments included the acquisition of an additional 50 percent stake in Newark Energy Centre, making EIF sole owner of the …

Source: www.infrastructureinvestor.com

Date Published: 5/16/2021

View: 5424

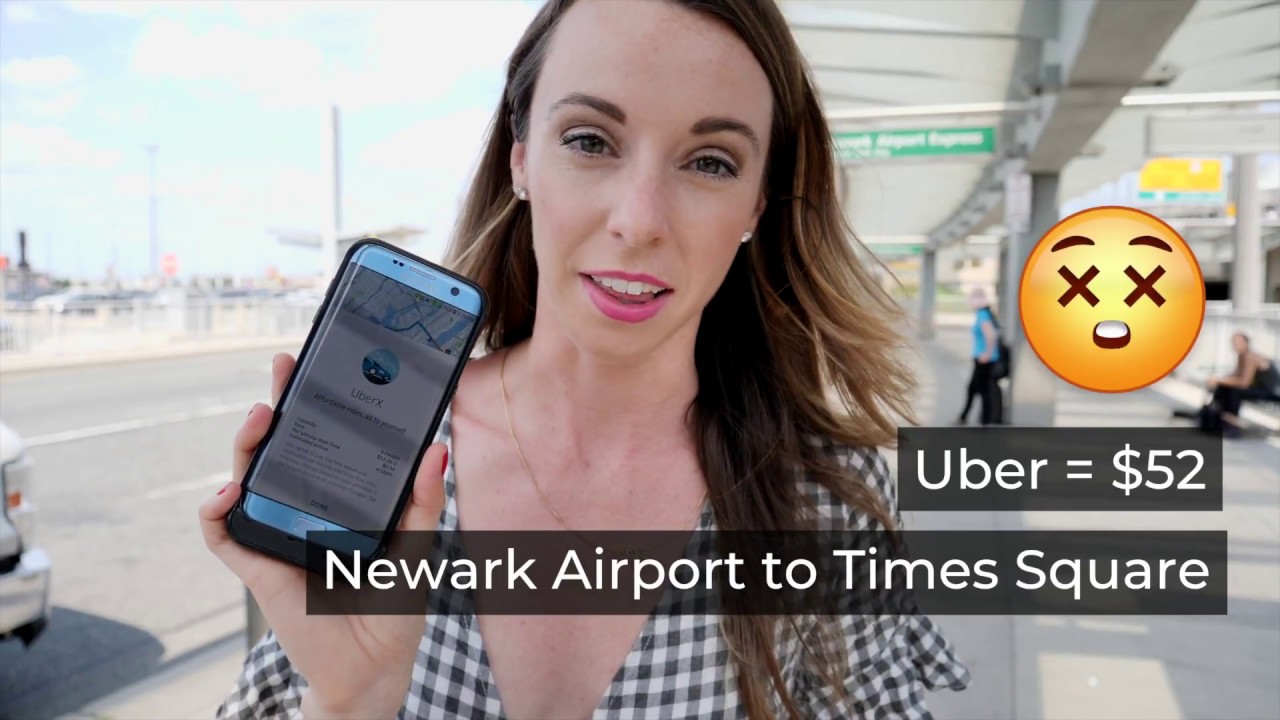

주제와 관련된 이미지 ares eif newark energy center

주제와 관련된 더 많은 사진을 참조하십시오 How to get from NYC airports to city center without getting ripped off. 댓글에서 더 많은 관련 이미지를 보거나 필요한 경우 더 많은 관련 기사를 볼 수 있습니다.

주제에 대한 기사 평가 ares eif newark energy center

- Author: Sarah Funk

- Views: 조회수 605,525회

- Likes: 좋아요 15,406개

- Date Published: 2018. 8. 3.

- Video Url link: https://www.youtube.com/watch?v=7k1VT9yDcw0

Newark Energy Center, US

Newark Energy Center is a 655MW gas fired power project. It is located in New Jersey, the US. The project is currently active. It has been developed in single phase. Post completion of construction, the project got commissioned in May 2015.

Project Type Total Capacity (MW) Active Capacity (MW) Pipeline Capacity (MW) Project Status Project Location Project Developer Thermal 655 655 – Active New Jersey, the US EIF-NEC; Hess Newark

Description

The project was developed by EIF-NEC and Hess Newark . The project is currently owned by Newark Energy Center with a stake of 100%.

It is a Combined Cycle Gas Turbine (CCGT) power plant that is used for Baseload.

The project cost is $924.801m.

Development Status

The project got commissioned in May 2015.

Contractors Involved

Skanska and SNC-Lavalin Group were selected to render EPC services for the gas fired power project.

GE Power was selected as the turbine supplier for the Gas fired project. The company provided 2 units of 7F.05 gas turbines.

GE Power was selected as the turbine supplier for the Gas fired project. The company provided 1 unit of GE D400 steam turbine.

GE Power supplied electric generator for the project.

Vogt Power International supplied steam boiler for the project.

NAES is the O&M contractor for thermal power project.

Methodology

All power projects included in this report are drawn from GlobalData’s Power Intelligence Center. The information regarding the project parameters is sourced through secondary information sources such as electric utilities, equipment manufacturers, developers, project proponent’s – news, deals and financial reporting, regulatory body, associations, government planning reports and publications. Wherever needed the information is further validated through primary from various stakeholders across the power value chain and professionals from leading players within the power sector.

Ares-EIF Puts PJM CCGT on Block

We use cookies to provide a personalized site experience.By continuing to use & browse the site you agree to our Privacy Policy

Ares Management’s Energy Infrastructure Funds Divest Operating Coal Portfolio

LOS ANGELES–(BUSINESS WIRE)–Ares Management L.P. (NYSE: ARES) announced today that funds managed by its energy infrastructure team, Ares EIF, have reached an agreement to sell a 1.2 gigawatt portfolio consisting of four power projects to Starwood Energy Group. Two of the projects are located in New Jersey, one is located in West Virginia and the other is in Arkansas. Terms of the sale were not disclosed. The transaction is subject to customary closing conditions and regulatory approvals and is expected to close in late 2017 or early 2018.

“This sale is significant for Ares EIF as it fits with our overall strategy of acquiring, optimizing and then divesting projects for the benefit of our long-term investors,” said Warren MacGillivray, Partner in Ares EIF. “The transaction also represents the disposition of nearly all remaining assets from a diversified portfolio consisting of 13 coal- and gas-fired assets acquired in 2007.”

Over the last two years, Ares EIF has transacted on more than $7.5 billion in the acquisition, development, construction, and monetization of power generation plants across the U.S. Among these transactions are the acquisitions and/or developments of Linden Cogenerating Station, Oregon Clean Energy and Newark Energy Center as well as its monetization of such institutional assets as Pio Pico Energy Center and Indiantown Cogeneration. Since inception in 1987, Ares EIF has made close to 70 equity investments in nearly 130 distinct power and energy infrastructure assets, with a total enterprise value exceeding $20 billion.

About Ares Management, L.P.

Ares Management, L.P. is a publicly traded, leading global alternative asset manager with approximately $106 billion of assets under management as of September 30, 2017 and more than 15 offices in the United States, Europe, Asia and Australia. Since its inception in 1997, Ares has adhered to a disciplined investment philosophy that focuses on delivering strong risk-adjusted investment returns throughout market cycles. Ares believes each of its three distinct but complementary investment groups in Credit, Private Equity and Real Estate is a market leader based on assets under management and investment performance. Ares was built upon the fundamental principle that each group benefits from being part of the greater whole. For more information, visit www.aresmgmt.com.

Ares Management to acquire power generator EIF Management

EIF Management LLC, Brooklyn Navy Yard Cogeneration Partners LP (BNYCP) and Ares Holdings LP filed a Nov. 5 application at the New York State Public Service Commission for approval for Ares to acquire 100% of the ownership interests in EIF, giving it control of several power plants in New York.

“Petitioners respectfully request that the Commission grant expedited review of this Petition and grant the relief requested herein no later than at the Commission’s December 4, 2014 stated meeting, so that the transactions contemplated herein may close by the end of the year,” the application said. “During the course of negotiations, Ares and EIF always contemplated a transaction that would close during 2014 and worked towards signing an agreement as soon as possible to meet this timing. In recognition of the importance of closing by year-end, the Petitioners are filing this Petition within four business days following execution of the agreement.

“There are a number of important public policy, business and personnel benefits for closing before year-end. First, in conjunction with the closing of the Proposed Transaction, Ares and EIF plan to launch a new investment fund. This fund, like its predecessor funds managed by EIF (including its most recent $1.7 billion fund) will invest in large part in development and construction stage greenfield power plants and other energy infrastructure assets in the United States. These assets will help to meet growing energy demand and replace less environmentally friendly coal fired power plant closures scheduled for 2015 and beyond. In the past, EIF Funds have helped to bring to fruition numerous clean and efficient energy assets such as the Panoche power plant in California, the Newark Energy Center under construction in New Jersey and the Hudson and Neptune Transmission Lines which alleviate congestion in NY Zone J and Zone K. Raising such a fund is a time and labor intensive effort that can be affected by financial market conditions as well as other factors. The sooner the parties are able to commence fundraising, the more likely such fund is to be successful and to be raised in time to meet the power generation and transmission needs noted above.

“Second, EIF will become part of a publicly traded firm as a result of the Proposed Transaction, and it is in the best interests of the public shareholders, as owners of Ares, that the Proposed Transaction be consummated by December 31, 2014.”

Involved assets include a couple of big plants, and small landfill gas generators

EIF manages the EIF Funds’ indirect ownership interests in the following entities that own generation facilities within New York: BNYCP, Selkirk Cogen Partners LP, Innovative Energy Services LLC (IES), and Seneca Energy II LLC.

BNYCP is the owner of an approximately 315 MW (maximum nominal) QF cogeneration facility located in Kings County, New York, in the New York ISO balancing authority area (BAA). It is interconnected within NYISO’s Zone J (New York City Submarket) to Con Edison Co. of New York (ConEd) to which it sells about 98% of its generation output under a long-term contract. Approximately 1.5% of the output is sold to Brooklyn Navy Yard Development Corp. (BNYDC), a not-for-profit entity that manages the New York City-owned former Brooklyn Navy Yard as an industrial park, for resale to BNYDC’s industrial park tenants pursuant to a long-existing energy sales agreement. Up to 0.5% may be sold to Tyche Power Marketing LLC for resale to BNYDC for BNYDC’s own use. The BNYCP facility provides the majority of its steam output to ConEd for distribution by ConEd to its steam service customers, and also provides a portion of its thermal energy under a contract with New York City in exchange for the right to take wastewater effluent produced at the Red Hook Water Pollution Control Plant.

Selkirk is the owner of an approximately 393.99 MW facility located in Selkirk, New York. The Selkirk facility is interconnected to the transmission facilities owned by Niagara Mohawk Power (NiMo) and operated by the NYISO. Selkirk currently sells the facility’s net output into the NYISO wholesale market at market-based rates.

IES owns all of the outstanding equity interests in the following entities, each of which owns a QF electric generating facility:

Innovative/Colonie LLC , an approximately 4.8 MW landfill gas electric generating facility in Cohoes, NY;

Innovative/DANC LLC , an approximately 4.8 MW landfill gas electric facility in Rodman, NY;

Innovative/Fulton LLC, an approximately 3.2 MW landfill gas electric facility in Johnstown, NY.

IES also owns 100 percent of the outstanding equity interests in:

Modern Innovative Energy LLC , which owns an approximately 6.4 MW landfill gas facility located in Youngstown, New York.

Model City Energy LLC, which owns an approximately 5.6 MW landfill gas facility also located in Youngstown, New York.

Seneca owns two electric generating facilities:

Seneca Falls Project (an approximately 17.6 MW landfill gas facility in Seneca Falls, NY); and

Ontario County Project (an approximately 11.2 MW landfill gas facility in Stanley, NY).

The buyer Ares is ultimately controlled by Ares Management LP, which is a publicly traded, alternative asset management firm with approximately $79bn of assets under management as of June 30, 2014. The common units of Ares Management are publicly traded on the New York Stock Exchange under the ticker symbol “ARES.” Ares Management operates four distinct but complementary investment groups that invest in tradable credit, direct lending, real estate and private equity assets.

As a result of the proposed transaction, Ares Management LLC will directly own 100% of the outstanding equity interests of EIF and thus Ares will have indirect control over the EIF New York affiliates.

EIF managers to come over to Ares under this deal

Said Ares Management in an Oct. 31 announcement about this deal: “Ares Management, L.P. (NYSE: ARES) announced today that one of its subsidiaries has signed a definitive agreement to acquire Energy Investors Funds (‘EIF’), a leading asset manager in the energy infrastructure industry with approximately $4 billion of assets under management (‘AUM’) across EIF’s four commingled funds and related co-investment vehicles. The acquisition is being financed primarily with cash, including a portion of the proceeds raised from the previously announced offering of senior notes by an indirect subsidiary of Ares, and with equity interests in Ares. The transaction is expected to close by the end of 2014, subject to regulatory approval and other customary closing conditions.”

“The energy sector is an area of increasing importance across our business given the large, growing and contractual nature of the asset class and the differentiated risk-adjusted returns that can be generated by experienced managers,” said Michael Arougheti, President of Ares Management. “EIF represents exactly what we look for in pursuing accretive, strategically valuable acquisitions. The team brings an established track record of excellence in an investment strategy that merits greater exposure for our collective fund investors, a strong cultural fit and a deep expertise that we believe will benefit Ares’ existing strategies.”

“We are thrilled to have EIF, a team that members of the Ares Direct Lending Group have known and respected for years, join the Ares Private Equity Group,” added Bennett Rosenthal, Senior Partner of Ares Management and Co-Head of the Ares Private Equity Group. “Since our inception, our private equity investment activities have meaningfully benefited from the scale and collaboration of the broader Ares platform, and we expect that the EIF team at Ares will also capitalize on our sourcing, market intelligence and relationship network advantages to enhance what is already superb investment performance.”

EIF’s investment team of energy private equity professionals will join the Ares Private Equity Group and maintain full day-to-day responsibility over EIF’s current and future private equity funds and related investments.

“Joining Ares is an exciting new chapter for our team, which has been generating strong returns for our fund investors and creating a thriving work environment for our employees for more than 25 years,” said Herbert Magid, a Managing Partner of EIF and a member of its Board, Executive and Investment Committees. “With the opportunity to work closely with our new colleagues across Ares, we believe we will be a more significant player at a time when there is a growing need for capital and sophisticated sponsorship in our markets.”

EIF was founded in 1987 as one of the first private equity fund managers focused on the independent power industry. EIF’s investment strategy is to create diversified portfolios of energy infrastructure related assets across the power generation, transmission, and midstream sectors that are expected to provide superior risk-adjusted equity returns with current cash flow and capital appreciation. From its offices in Boston, New York, and San Francisco, EIF manages over $4bn of AUM in four comingled private equity funds as well as related co-investment vehicles as of Sept. 30, 2014.

Newark energy center

Newark energy center is a 735-megawatt (MW) natural gas power station in the state of New Jersey, United States.

Location

The map below shows the exact location of the power station in Newark, United States.

Loading map… {“type”:”SATELLITE”,”minzoom”:false,”maxzoom”:false,”types”:[“ROADMAP”,”SATELLITE”,”HYBRID”,”TERRAIN”],”mappingservice”:”googlemaps3″,”width”:”600px”,”height”:”500px”,”centre”:false,”title”:””,”label”:””,”icon”:””,”lines”:[],”polygons”:[],”circles”:[],”rectangles”:[],”copycoords”:false,”static”:false,”visitedicon”:””,”wmsoverlay”:false,”zoom”:16,”layers”:[],”controls”:[“pan”,”zoom”,”type”,”scale”,”streetview”,”rotate”],”zoomstyle”:”DEFAULT”,”typestyle”:”DEFAULT”,”autoinfowindows”:false,”resizable”:false,”kmlrezoom”:false,”poi”:true,”cluster”:false,”clustergridsize”:60,”clustermaxzoom”:20,”clusterzoomonclick”:true,”clusteraveragecenter”:true,”clusterminsize”:2,”imageoverlays”:[],”kml”:[],”gkml”:[],”searchmarkers”:””,”fullscreen”:false,”scrollwheelzoom”:false,”locations”:[{“text”:””,”title”:””,”link”:””,”lat”:40.7072,”lon”:-74.125799999999998,”icon”:””}]}

Project Details

Owner : Energy Investors Funds [100%] [1]

: Energy Investors Funds [100%] Parent : Ares Management Corporation [100%] [2]

: Ares Management Corporation [100%] Location : Newark, Essex, New Jersey, United States

: Newark, Essex, New Jersey, United States Coordinates : 40.7072, -74.1258 (exact) [3]

: 40.7072, -74.1258 (exact) Gross generating capacity (operating) : 735 MW Unit CCST: Natural gas [3] combined cycle [3] , 735 MW [3] (start-up in 2015) [3]

: 735 MW

Articles and Resources

References

Ares to acquire Energy Investors Funds

Nearly there!

A verification email is on its way to you. Please check your spam or junk folder just in case.

If you do not receive this within five minutes, please try to sign in again. If the problem persists, please email: [email protected]

키워드에 대한 정보 ares eif newark energy center

다음은 Bing에서 ares eif newark energy center 주제에 대한 검색 결과입니다. 필요한 경우 더 읽을 수 있습니다.

이 기사는 인터넷의 다양한 출처에서 편집되었습니다. 이 기사가 유용했기를 바랍니다. 이 기사가 유용하다고 생각되면 공유하십시오. 매우 감사합니다!

사람들이 주제에 대해 자주 검색하는 키워드 How to get from NYC airports to city center without getting ripped off

- nyc airports

- jfk airport

- new york city

- new york city (city/town/village)

- laguardia airport

- newark airport

- newark airport to nyc

- jfk airport tour

- jfk airport to nyc subway

- laguardia airport to nyc subway

- how to get from airport in nyc

- airport directions nyc

- airport tips nyc

- newark airport to world trade center

- new york

- john f. kennedy international airport (airport)

- laguardia airport to new york city

- newark airport to penn station

How #to #get #from #NYC #airports #to #city #center #without #getting #ripped #off

YouTube에서 ares eif newark energy center 주제의 다른 동영상 보기

주제에 대한 기사를 시청해 주셔서 감사합니다 How to get from NYC airports to city center without getting ripped off | ares eif newark energy center, 이 기사가 유용하다고 생각되면 공유하십시오, 매우 감사합니다.